maryland student loan tax credit amount

Incurred at least 20000 in total student loan debt. To repay the credit.

Stevie G On Twitter Along With This Federal Loan Forgiveness If You Live In Md Make Sure To Take Advantage Of The Loan Repayment Tax Credit We Get On Our State Taxes

IMPACT OF FEDERAL STUDENT LOAN FORGIVENESS ON MARYLAND INDIVIDUAL INCOME TAX.

. Maryland Student Loan Tax Credit Amount. If the credit is more than the taxes you would otherwise owe you will receive a. To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate.

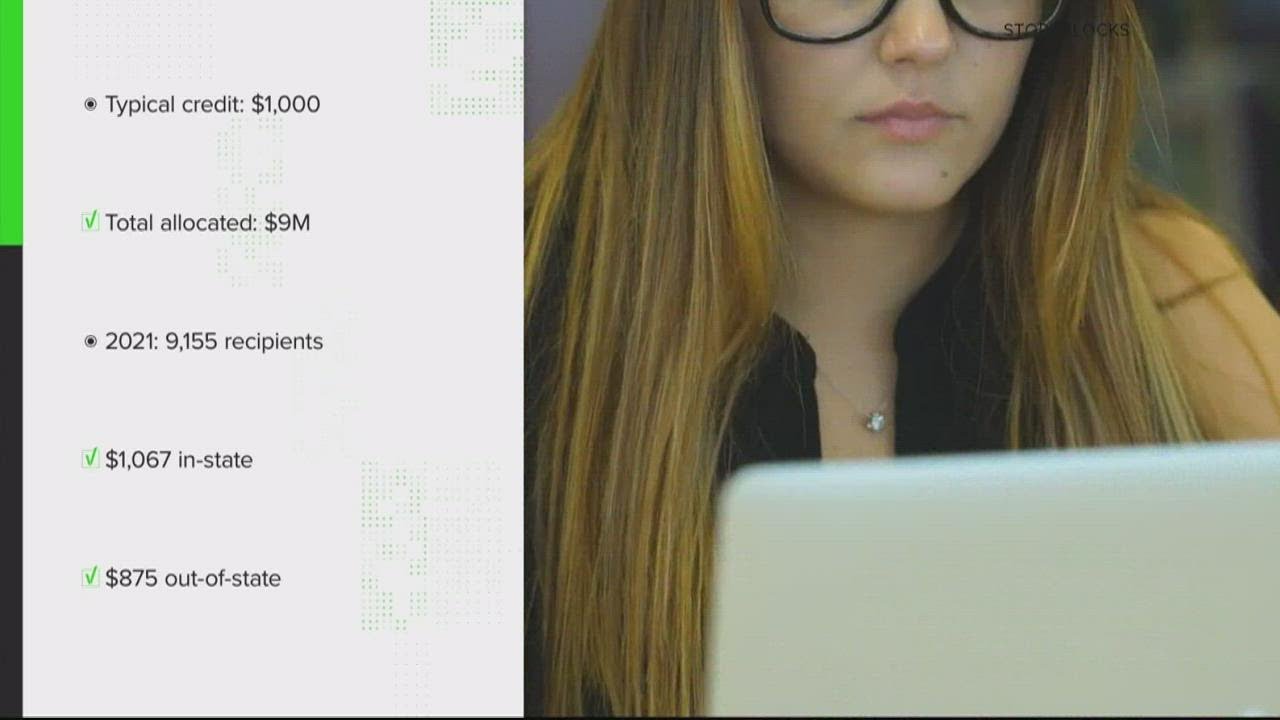

The site outlined that in 2021 close to 9000 residents of Maryland. Maryland taxpayers who maintain Maryland residency for the 2022 tax year who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at. Student Loan Debt Relief Tax Credit.

The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit. It was founded in 2000 and has. Eligible people have until Sept.

Maryland Student Loan Tax Credit Amount. About the Company Maryland Student Loan Debt Relief Tax Credit Award Amount. How to apply for Marylands student loan debt relief tax credit.

Maryland r esidents looking to claim student loan debt relief must do so in less than two weeks. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. With more than 40 million distributed through the.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. On August 24 2022 President Joseph R.

Should parents pay for college reasons for reasons not to money bliss parent pay college tuition loans for bad credit. File Maryland State Income Taxes for the 2019 year. CuraDebt is a company that provides debt relief from Hollywood Florida.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000 Marylanders. There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions.

The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the. To qualify for the Student Loan Debt Relief Tax Credit you must. Student Loan Debt Relief Tax Credit.

15 to apply for a Student Loan Debt Relief Tax. More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. Should parents pay for college reasons for reasons not to money bliss parent pay college tuition loans for bad credit.

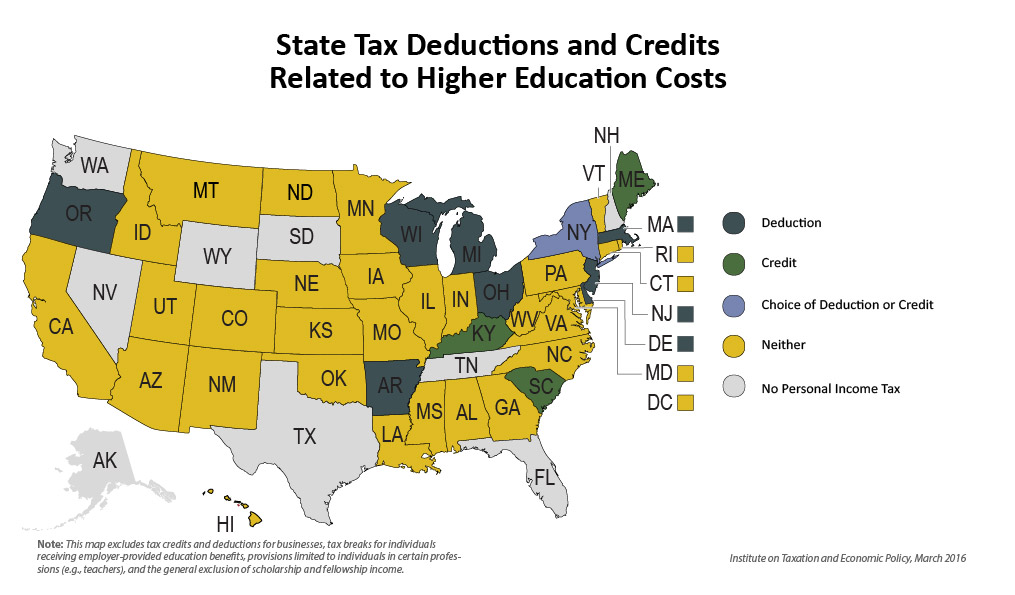

Higher Education Income Tax Deductions And Credits In The States Itep

Paula Dofat Author At Central Scholarship

9m In More Tax Credits Available For Maryland Student Loan Debt

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

Maryland Offering Tax Credit For Student Loan Debt Sc H Group

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Maryland Student Loan Tax Credit Tiktok Search

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

Hogan Proposes Student Loan Interest Tax Credit Public College Tuition Cap The Washington Post

How To Claim The Maryland Student Loan Tax Credit Fire Esquire

Comptroller Franchot Urges Marylanders To Apply For Tax Credit Bay To Bay News

Maryland S 1 000 Student Debt Relief Tax Credit How To Apply Deadline

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Verify Is Maryland Giving Students With Outstanding Debt A Tax Break For 2017 Wusa9 Com

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt Southern Maryland News Net Southern Maryland News Net

Applications Being Accepted In Maryland For Student Loan Debt Tax Credit Wjla

Student Loan Debt Relief Tax Credit Available To Taxpayers In Maryland Brown Schultz Sheridan Fritz

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com